Retirement Planning - Top 5 things to think about for your retirement

Gone are the days when retiring was easy.

The self-conscious display of thanks from work colleagues, followed by the gracious acceptance of a well-meaning gift. Then a trip to the local watering hole where everyone downed the obligatory two drinks then quietly disappeared.

The retiree was then left with nothing more taxing to do than ponder how they would fill their blissful, work-free days from now until eternity.

With Australians living longer, retirement is more than just a few years. This means there’s much more to think about so we’ve put together a list of things to consider if you're looking to retire this year.

Life expectancy

Baby Boomers are starting to retire. They’re also living longer, are young longer (called down ageing) and are absolutely not going to quietly fade into the background. If you love a good statistic, you’ll want to read our article about Baby Boomer wealth statistics in Australia. However, to cut to the chase, the Australian Institute of Health and Welfare (AIHW) tells us:

‘Men aged 65 in 2017–2019 could expect to live another 20.0 years (an expected age at death of 85.0 years), and women aged 65 in 2017–2019 could expect to live another 22.7 years (an expected age at death of 87.7 years).’

Although Australia doesn’t have a fixed retirement age, according to the Australian Bureau of Statistics (ABS), the average age of retirement is 55.4 years.

That means, today’s retiree will need to sustain themselves for around 30 years. While it’s no secret Baby Boomers are the wealthiest generation in history, unless they’ve put time into some considered estate planning, they may not have access to the cash they need to support their current lifestyles on a day to day basis.

How much money will you need to retire comfortably?

We addressed this question in greater detail here but, as with everything, it all depends. What does retirement look like for you? Do you plan on travelling the world in the lap of luxury? Or is maintaining your current lifestyle, just with a lot more free time, your idea of a perfect retirement?

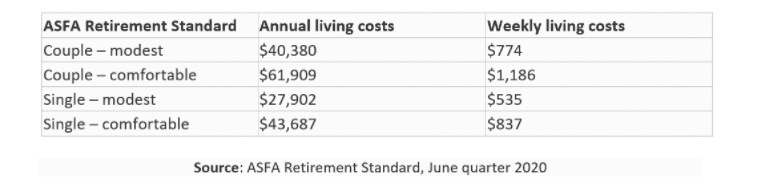

The accepted wisdom is you’ll need around two-thirds (67 percent) of your pre-retirement income to maintain your standard of living. In fact, the Association of Superannuation Funds of Australia (ASFA) has estimated how much money you’ll need, according to lifestyle.

The 2020 Global Retirement Reality Report found 42 percent of Australians are not optimistic about their retirement. They had similar results when they asked the same question in 20218. The report noted:

‘Although not a direct result of COVID-19, we continue to see a lack of retirement confidence in Australia. The crisis has only exacerbated long-standing issues around lack of savings and uncertainty of retirement outcomes.’

With about 50 percent of the Australian population relying on the government’s Age Pension as their main income source, and many people having dipped into their Super during the pandemic, it’s no wonder people are worried.

Do you really want to retire?

Do you really want to retire? Or are you planning to retire this year because you’re at retirement age and feel you should just retire?

We already know there's no hard and fast rules around a retirement age so, if you don’t want to, then why do it?

Your health is good. Your love your life just the way it is. Maybe you’ve already handed off some work to your kids (if you’re running a family business) or dropped down to part time work. You don’t have any grand plans that require you not working so, is full time retirement really for you this year?

Have you considered a transition to retirement income stream?

If you do happen to be someone who doesn’t want, or need to, retire completely, you’re in luck. Maybe you like the idea of working 1 to 2 days, especially now that working from home is a thing. Or perhaps your finances just won’t allow you to retire 100 percent. Whatever the reason, you may want to think about a transition to retirement (TTR) income stream.

What is a TTR?

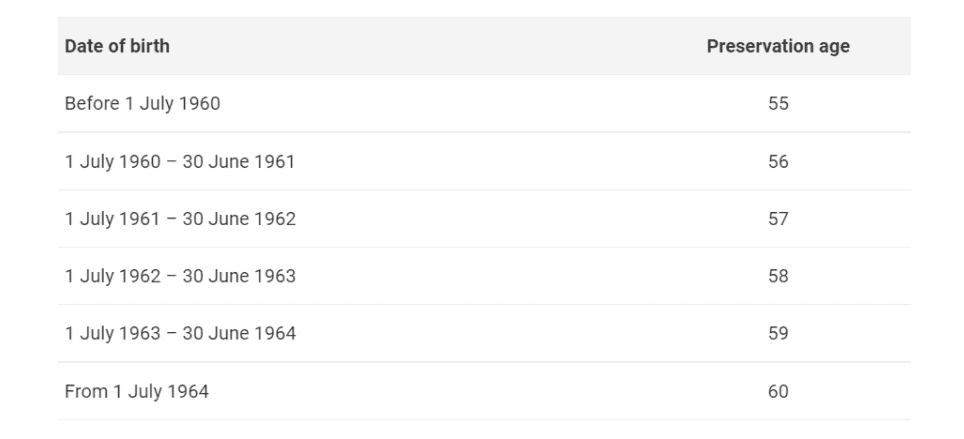

A transition to retirement (TTR) scheme means once you reach around 55 to 60 years and you’re still working, you can begin to access your super to supplement your income. When this happens will depend on your superannuation preservation age, the age when you can legally access your super. And your preservation age is determined by your date of birth.

Using a TTR strategy, a transition to retirement income stream (TRIS), means you can boost your superannuation, save tax and keep working.

It’s worth mentioning that if you’re over 60, any money you get from a TTR pension is completely tax free. Even if you’re under 60, by making voluntary concessional contributions to your super, or salary sacrificing, you’re taxed on these at the concessional tax rate of 15 percent.

Retirement has changed

The world has changed a lot in the last 50 years. We’re living longer, staying younger and people don’t want the same things their parents did. Far from fading into the shadows and becoming on-call babysitters for grandkids, today’s retirees are shaking things up. Baby Boomers grew up in a different world and they’ll be retiring (or not) into a different world again.

But one thing remains the same. And that’s getting sound financial and accounting advice from people you can trust. So, when (and if) you want to talk about preparing yourself and your finances for retirement, talk to a trusted professional financial advisor.